Commercial health insurance in the United States is health insurance that is employer sponsored or privately purchased and not provided by the government (i.e. Medicare, Medicaid, Tricare, etc).

Every fall, the time comes once again to select your health benefits for the next year which can make you want to pull your hair out in trying to figure out what is the best plan for you and your family. The United States healthcare system leaves a lot to be desired, but it’s especially not great for people who have chronic health conditions as it is designed for quick fixes such as a broken arm or an ear infection and not those who have continual health episodes as the norm. Strides are being made to shift our healthcare system to be value based instead of episode based which helps with chronic condition management, but there is still a long way to go to achieve this model of care for the entire healthcare system (this is a topic for another day). While health insurance plans try to reward you for staying healthy or provide plan options at reduced costs if you are someone who isn’t sick often, what do you do if your healthy state (i.e. diabetes) is an uncurable, chronic condition that requires astronomical healthcare fees to not only stay well but stay alive!? There is not an easy (or cheap) answer to this question.

As a consumer of healthcare with a chronic health condition and a heavy user of commercial health insurance for many years, I wanted to share my research and thought process on how to choose the best commercial health insurance plan for you and your family when diabetes is involved. My experience is based off living with type 1 diabetes so not applicable to everyone, but I feel the same themes do apply across all health scenarios if you are reading this as someone who does not have diabetes.

Before we get into all the considerations for choosing a health insurance plan, you need to have an understanding of commercial health insurance structure and what all the terms mean that go along with it so without further ado….

The 1-0-1 on Health Insurance

Premium

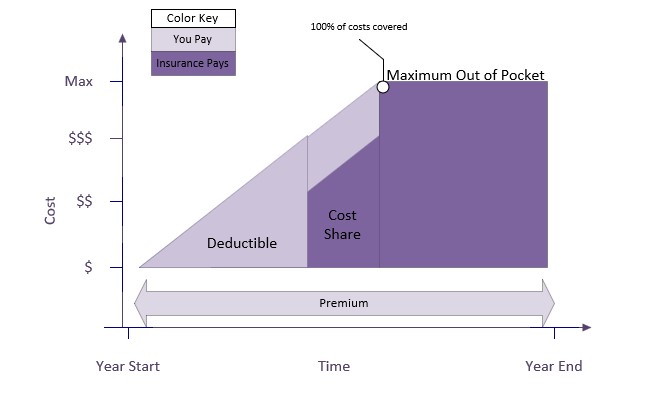

A Premium is a monthly or per paycheck fee for health insurance plan coverage (think of this as a subscription fee to the health insurance plan).

- This is deducted from your paycheck if you have employer sponsored health insurance or paid monthly if paying privately.

- The Premium is deducted from a paycheck pre-tax.

- This does not count towards your deductible or maximum out of pocket amounts.

Premiums vary in cost based on the type of health insurance plan, but generally speaking, lower deductible plans have a higher monthly premium and higher deductible plans have a lower monthly premium.

Deductible

A deductible is the total amount you must pay for medical expenses before your health insurance will start paying. This means 100% of all costs are paid by you out of pocket until that amount is met (there is a work around to paying this 100% directly out of pocket that we will get to when discussing FSA and HSA accounts).

There are 2 types of deductibles:

- Aggregate Deductible: all persons on the health insurance policy contribute to 1 deductible amount. Example, If the deductible amount is $3,000 and 3 people are on that health insurance policy, then all 3 people’s medical expenses contribute towards that $3,000 no matter how many or how few claims each person may have.

- A claim is each service or fee charged against your health insurance plan for medical services, equipment, prescriptions, etc. you receive.

- Embedded Deductible: each person on the health insurance policy has their own deductible. Example, if 3 people are on the health insurance policy, then each person has their own deductible amount of, let’s say, $400 so one person may meet their $400 deductible before another person even has 1 claim against their deductible.

Most insurance plans do have services that are 100% covered even before you meet your deductible. These services usually fall under the category of preventive services like well visits, routine immunizations, routine physicals, mammograms, etc. This is your “reward” for making the effort of staying healthy and preventing illness where possible. The insurance policy will list out all the services 100% covered from the start.

Co-insurance or Cost Share

Once the deductible amount is met, you will enter the cost share or co-insurance phase that occurs in the time between the deductible being met and reaching the out of pocket maximum. Sharing the cost means you and the insurance plan each pay an amount to add up to 100% of that cost. Usually insurance plans pay 80% in the cost share phase meaning you are responsible for the remaining 20% of the cost, but this percentage split can vary based on the type of insurance plan.

Copays (Copayments)

A copay is a fixed amount to pay for a covered service at the time of that service. Copays do not contribute towards the deductible, but they do contribute towards the out of pocket maximum.

Maximum Out of Pocket

Maximum Out of Pocket is the total out of pocket cost you pay before the insurance plan starts paying 100% of all costs meaning you no longer pay anything for medical expenses (except for your premium) once your maximum out of pocket is met.

- Your deductible amount contributes toward your maximum out of pocket amount. It is not in addition to.

- The maximum out of pocket can be aggregated or embedded just as the deductibles can with the same definition where an embedded deductible will have an embedded maximum out of pocket, and an aggregate deductible will have an aggregate maximum out of pocket.

This page from UnitedHealthcare provides a nice summary of copays, coinsurance, and out of pocket maximum at this link here: https://www.uhc.com/understanding-health-insurance/understanding-health-insurance-costs/types-of-health-insurance-costs/copay-coinsurance-and-out-of-pocket-maximum

Total Cost

Total Cost for the year = Premium + Maximum Out of Pocket

What I’m terming as “total cost” is not an actual health insurance term, but what I use to compare health plans against each other for pricing and what I would spend in a year. Your total cost for the year will be the total of all your premiums paid each month plus the maximum out of pocket amount. This is the most you would pay in the calendar year. However, it could be less if you do not reach your out of pocket maximum. No matter which health insurance plan you use, monthly cost will fluctuate based on services used and where you are at in the deductible/maximum out of pocket process so looking at the projected total cost at the end of year provides an objective data point to compare plan price points.

Types of Health Insurance Plans

The other language you will see often in association with insurance plans is the type of plan listed as a HMO, PPO, or EPO.

Health Maintenance Organization (HMO) plans require you to have a PCP (primary care provider) who then makes referrals to specialists as needed. Your PCP is then coordinating or maintaining your overall health. HMO plans tend to have lower monthly premiums and out of pockets costs, but a smaller network of Providers to choose from and no coverage for out of network care.

Preferred Provider Organization (PPO) plans don’t require you to have a PCP or a referral to see a specialist providing more flexibility in choosing your Providers. Hence, the “Preferred Provider” in the title. PPOs have a larger Provider network and some coverage for out of network care. However, this flexibility results in larger monthly premiums and out of pocket costs.

Exclusive Provider Organization (EPO) plans are a hybrid between a HMO and PPO. It requires that you use a pre-approved network of Providers, but there is more flexibility and a larger network than HMOs. There is usually no coverage for out of network care like what is offered in a PPO.

This page from Cigna does a nice comparison between these 3 types of plans if looking for further information: https://www.cigna.com/knowledge-center/hmo-ppo-epo

Within each type of insurance plan, there is the option of individual, individual + spouse, individual + child(dren), or family coverage. The options can vary across plans and insurance providers as some only have the options of individual or family, but the number of people needing coverage on the insurance plan will determine price meaning the more people to be covered, the higher the cost of the premium, deductible, and out of pocket maximum.

Flexible Spending Account (FSA) and Health Saving Account (HSA)

FSAs and HSAs are accounts dedicated to paying for medical expenses and offer tax advantages as the money in these accounts is deducted directly from your paycheck pre-tax. These funds can also make you feel like you are spending less money (which you are slightly in saving the income tax) since you are not seeing medical expenses hit your personal bank account if you pay with a HSA or FSA. These accounts have a maximum amount that can be contributed for the year. The maximum amount depends on if you are enrolling in an individual or family insurance plan or whether it is a FSA or HSA. During insurance enrollment, you will choose what amount you want to be in the FSA or HSA and then that amount is divided by the number of paychecks you receive in a year so every paycheck makes the same contribution into the FSA or HSA account.

If you remember from earlier under the deductible section, I said there was a way around direct out of pocket expenses, and a FSA or HSA account is it. The maximum amount available for a FSA/HSA is usually right around or higher than the maximum out of pocket cost of an insurance plan. This means that if you contribute at least the maximum out of pocket cost of your insurance plan to a FSA/HSA account, you don’t have to consider health expenses as part of your disposable income. If you don’t think you will have enough medical expenses to reach the maximum out of pocket amount, contribute the amount of your deductible as a minimum.

Utilizing a FSA or HSA account removes medical expenses from your disposable income.

The similarities between a FSA and HSA are that they are both used to spend money on qualified medical expenses and contributions are made pretax. Here are the differences:

| FSA (Flexible Spending Account) | HSA (Health Savings Account) |

| Employer owned and associated only with your current employer | Individual owned and can carry to different employers |

| Available through a variety of employer owned plans | Must be enrolled in a HSA-eligible high-deductible health plan (HDHP) as your only health insurance |

| Employer does not contribute any amount to the account | Employer contributes an amount to the account (“free money”) |

| Unused FSA funds can NOT be rolled over to the next year | Unused HSA funds can be rolled over to the next year. |

| Entire amount available for use at the start of the year | Amount accumulates as you contribute |

| Lower maximum amount than a HSA | Higher maximum amount than a FSA |

| Balance does not earn interest | Pays interest |

| Contributions not taxed | Contributions are tax deductible, growth is tax-deferred, and spending is tax free |

| Withdrawals only for qualifying medical expenditures | May withdrawal for non-qualifying medical expenditures subject to taxes and penalties |

| Cannot invest funds in the account | Can invest funds to grow the money in the account |

| No retirement options | At age 65, can be used like a traditional 401(k) or IRA |

If you take away anything from reading this blog post, let it be to open a FSA or HSA with your next insurance enrollment if you haven’t in the past. It’s an easy way to save and manage your money for medical expenses with tax advantages.

Picking a Plan that is Best for You

With all that being said, how do you use the knowledge from above to pick the best plan? What may come as as surprise (or maybe not!) is the key factor in choosing an insurance plan comes down to cost and financial options more so than the plan itself.

First, calculate total cost across all the plans being considered.

Total cost will be the premium multiplied times the number of times it will be paid in the year (usually 26 if paid bi-weekly) and then added to the maximum out of pocket amount. This would be the most you would pay for the entire year, but it would be less if you don’t reach the out of pocket maximum. This will give you an objective way to compare plan prices. For example,

| Health Plan A | Health Plan B | |

| Premium | $50 | $100 |

| Yearly Premium (x26) | $1,300 | $2600 |

| Deductible | $1,500 | $1,000 |

| Out of Pocket Max | $2,500 | $2,000 |

| Total Cost (Yearly Premium + Out of Pocket Max) | $3,800 | $4,600 |

Health Plan B looks like the best option as the deductible and out of pocket maximum are lower so you’d be thinking lower out of pocket costs. However, since the premium is higher, that plan actually costs more in the long run.

Second, review Provider networks across the plans.

Look to see if your desired Providers are considered in or out of network with the plan and how in and out of network affects costs associated with the plan. Out of network is either not covered or has a higher out of network deductible and out of pocket maximum. Referring back to the Health Plan A and B example, even though Health Plan A is $800 less for the year, those expenses may be made up if your Providers are not in network so important to consider Provider networks in your decision making.

You will also want to look at how specialists are covered since diabetes care such as seeing an endocrinologist falls under specialist care. Costs can be different or have a different copay for specialist visits. FYI, A diabetic eye exam is usually covered as a medical expense and not through vision insurance so you do not need vision insurance only for the sake of covering a diabetic eye exam, but may need to check if the eye doctor is in or out of network.

Third, look at how prescription and pharmacy costs are handled across the plans.

A majority of diabetic costs come from prescriptions so it’s important to understand how your medications and pump/CGM supplies are covered.

Consider these items:

- How do prescription costs count towards the deductible and out of pocket maximum? Some plans have prescription costs that don’t count towards your deductible and only the out of pocket maximum so with a majority of costs coming from prescriptions, it would take longer to reach your deductible.

- Are generic vs. name brand medications handled differently? Is there a preferred formulary or tiering of preferred medications? Most plans have a preferred formulary or tiering of medications and handle generic vs. name brand medications differently which also affect cost.

- Are there different costs associated with a 30 vs. 90 day supply?

- Are there different costs for a local vs. mail order pharmacy?

In Summary…

It all comes down to cost, how costs are handled, and how you prefer to manage your health expenses. In terms of diabetes in my experience, it comes down to total cost, Providers, and prescriptions, but those 3 can change based on you and your medical history. Regardless of which plan you choose, open a FSA or HSA for a minimum amount to cover your out of pocket costs so health expenses are removed from your disposable income and have their own dedicated bucket of money.

Health insurance can be a nightmare, but I hope this provided some clarity around health insurance decision making and happy enrollment!

If you have any tips, tricks, or stories on choosing the best health insurance options, I’d love to hear from you or add a comment below!

Leave a comment